About Sole Strivers

At Sole Strivers, we believe financial success is about more than just numbers—it’s about creating a life of stability, opportunity, and freedom. Our mission is to provide individuals and organizations with the tools, knowledge, and strategies to take control of their financial futures, no matter their starting point.

Where Personal Finance Meets Real Life

Our programs include personalized coaching, interactive workshops, and educational resources designed to help you break through obstacles—whether it’s overcoming debt, building wealth, or planning for a major life transition. We understand that financial literacy is not one-size-fits-all, which is why we offer tailored solutions in multiple languages, ensuring that more people can access the information they need to thrive.

About Our Founder

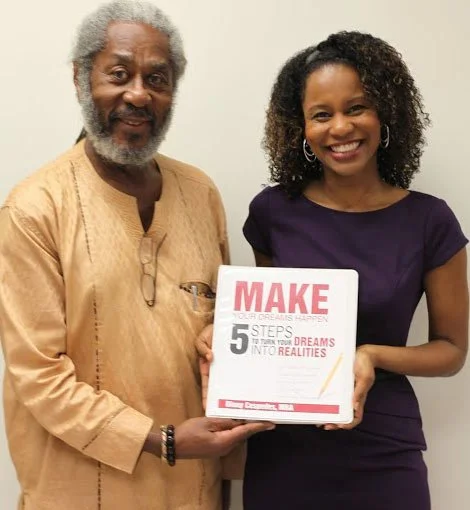

Diony Cespedes, M.S. Ed., MBA

Dionisia “Diony” Cespedes is a financial coach and business strategist who built Sole Strivers Financial Fitness to help clients achieve goals related to financial wealth and well-being. She defines wealth as: Health+Happiness+Cash+Time+Income producing assets.

Diony has more than 20 years of corporate and start-up experience, playing lead roles in over 160 projects with budgets ranging from $10,000 to $100 million. She has created and/or executed strategies for large organizations including: ABN AMRO Bank, Rothschild Advisors, Warner Music Group, Aetna, and the State University of New York.

Diony is also the author of Make Your Dreams Happen—5 Steps to Turn Your Dreams into Realities, a goal attainment guide. Her personal finance articles have appeared in a variety of media including: LatinTrends Magazine, Triple the Focus, World Bride Magazine, The Network Journal, BET.com, and NV Magazine. Recently, she was quoted in the book The Freelance Mindset: Unleashing Your Side Hustles for Better Work, Play, and Life Hardcover written by Joy Batra (2023).

Diony earned a dual Bachelor of Arts degree in Psychology and Marketing from the State University of New York at Plattsburgh, a certificate in Finance from Baruch College, a Master of Science in Education from the City College of New York where she graduated with highest honors (4.0/4.0), and a Master of Business Administration from Howard University, where she was a Howard University Trustee Scholar. She speaks French and Spanish.

Q&A with Our Founder

-

Sole Striver is a person from a modest background who is among the first in their family and or peer group to begin building a net worth higher than $100,000. Sole Strivers have a unique set of challenges that can range from not understanding personal finance to managing survivor guilt or being/feeling responsible for the welfare of others before establishing their own financial stability.

-

Absolutely! I was the first one. I made so many financial mistakes when I was building wealth in my 20’s. I essentially gave away and spent the first $100,000 I amassed. Worse, I used credit cards to plunge myself into about $150,000 in debt. I started using credit cards to “earn” points and perks at first. Then I used them to cover payroll when clients didn’t pay bills on time or to pay for products/services/charity I couldn’t afford. I didn’t know that I needed a financial team (accountant, lawyer, financial planner etc.). I thought a team was only for rich people. I also didn’t know the importance of building and managing personal relationships. My biggest mistakes: I spent money to assuage survivor guilt; and I didn’t work hard enough to add people to my network who had similar backgrounds and ambitions as I did.

-

It was E.S.S.I (pronounced: easy). I just changed my earning, saving, spending, and investing habits.

Earn- I got a job at an organization that paid me well.

Spend- I ate ramen noodles and veggies from the discount bin while I repaid my debt. It took 3 years.

Save – I built a healthy emergency fund and didn’t touch it.

Invest – I invested as much as legally possible in a 401k retirement fund. Then I reinvested in an “emergency fund” for my own company to avoid ever having to borrow high interest debt to cover payroll. Most importantly, I invested in education. I took formal and informal classes to learn how to manage money. I earned a certificate in finance and an MBA.

-

No! You can start with 0 dollars or have a negative net worth because of debt. You just need the desire to build a six to seven figure net worth AND the willingness to take action. Our debt reduction coaching programs are among our most popular offerings and many of those clients are starting with negative net worths.

-

The DREAM™ system is the way we guide clients to turn their dreams into realities. DREAM stands for Dream big, Research, Evaluate, Act and Measure progress.

-

Our mission is to help people build financial and physical freedom for themselves. My goal is to provide the tools to make this possible for millions of people.